Massachusetts Tax Rates, Standard Deductions, Forms

Content

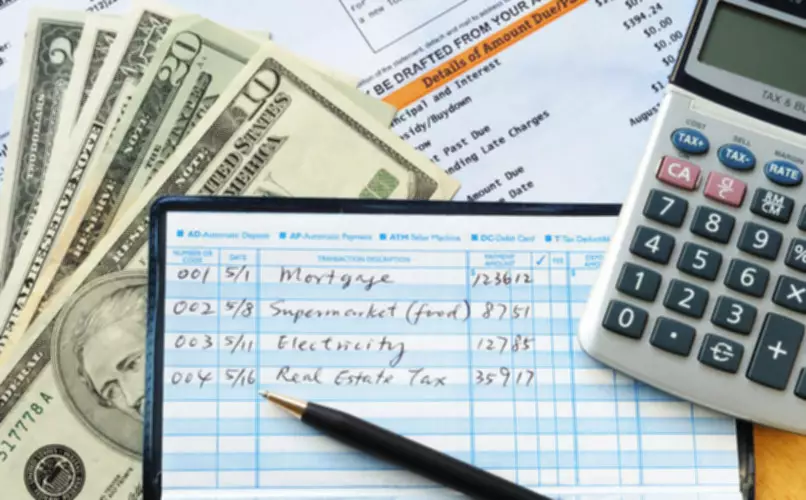

Table 1 compares tax rates in Connecticut and Massachusetts for state taxes affecting a broad range of taxpayers. The table includes only the tax rate and basis for each tax. It does not include other provisions that could affect the amount of taxes an individual or business taxpayer must pay (e.g., exemptions, deductions, credits, and apportionment formulas). A nonresident employee who, prior to the Pandemic determined MA-source income by apportioning based on days spent working in MA must continue to do so (please see MA 830 CMR 62.5A.3 for this specific rule). If you are single you can claim a standard deduction of $12,400.

How to withhold Paid Family and Medical Leave Contribution from employee paychecks. Gasoline and diesel taxes in Massachusetts each total 24 cents per gallon. On the other hand, Massachusetts’ taxes on alcohol are some of the lightest in the U.S. These taxes are 11 cents per gallon of beer, 55 cents per gallon of wine and $4.05 per gallon of liquor. A financial advisor can help you understand how taxes fit into your overall financial goals.

Shop for Services

does massachusetts have state income tax provides a wide array of credits including an earned income tax credit, a circuit breaker credit and a solar, wind and energy tax credit. Because income, particularly from capital gains, is closely tied to economic performance, it can be a volatile source of revenue. Our free, online guide covers multiple aspects of managing Massachusetts sales tax compliance, including business registration, collecting sales tax, filing sales tax returns and state nexus obligations. As such, Massachusetts nonresidents will only be subject to Massachusetts personal income tax on actual Massachusetts work-days after the special rules expire. Massachusetts Governor Charlie Baker signed the 2023 Fiscal Year Budget on July 28, 2022.

- Our free, online guide covers multiple aspects of managing Massachusetts sales tax compliance, including business registration, collecting sales tax, filing sales tax returns and state nexus obligations.

- You can pay your Massachusetts state taxes online at MassTaxConnect (through the state’s Department of Revenue) or via mail.

- All examples are hypothetical and are for illustrative purposes.

- SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

1″In 17 states, the government directly controls the sales of distilled spirits. Revenue in these states is generated from various taxes, fees, price mark-ups, and net liquor profits.” Compare state tax rates in Connecticut and Massachusetts. Planning to avoid the additional tax may be time well spent. Some things can be done in 2022 to accelerate income into the current year, while others include opportunities for 2023 and beyond. It is important to consult with your tax and wealth advisors to help ensure you make the decisions in this area that best fit your individual circumstances and fulfill your objectives. Massachusetts will require the payment of estimated taxes if you expect to owe more than $400 in taxes on income not subject to withholding.

One-Time Supplemental Payments

The Income Tax Course consists of 62 hours of instruction at the federal level, 68 hours of instruction in Maryland, 80 hours of instruction in California, and 81 hours of instruction in Oregon. Additional time commitments outside of class, including homework, will vary by student. Additional training or testing may be required in CA, OR, and other states. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block.

Some Massachusetts cities and towns also offer property tax “work-off” abatement programs, which allow seniors to do volunteer work for their local governments in exchange for a reduction of up to $1,500 on their property taxes. Senior homeowners age 60 or older must meet local program requirements to participate. Here you can find how your Massachusetts is based on a flat tax rate. When you prepare your return on eFile.com this is all calculated for you based on your income. Generally, Massachusetts taxes capital gains as ordinary income. However, certain capital gains are taxed at a rate of 12%.

Massachusetts Withholding Forms

Massachusetts has a flat income tax rate of 5.00%, as well as a flat statewide sales tax rate of 6.25%. The state’s income tax rate is only one of a handful of states that levy a flat rate. If you are not a resident of Massachusetts, have a complicated tax return, or have other specialized circumstances you may need to download additional tax forms from the website. You can find all of Massachusetts’ 2023 income tax forms on the income tax forms page . Form PV – Payment VoucherIf you owe any payment to Massachusetts for income taxes, you need to file Form PV along with your tax forms and payment. Complete and e-File your Massachusetts Income Tax Return on eFile.com along your Federal Tax Return.

Is Massachusetts a high tax state?

Massachusetts has an 8.00 percent corporate income tax rate. Massachusetts has a 6.25 percent state sales tax rate and does not levy local sales taxes. Massachusetts's tax system ranks 34th overall on our 2023 State Business Tax Climate Index.

Massachusetts full-year and part-year residents who have a principal residence within the state may qualify for the Solar, Wind and Energy Tax Credit. The credit is only for solar and wind energy sources. You can claim the smaller of 15% of the net expenditure for the renewable energy source property or up to $1,000. If you split the rent with someone else, each taxpayer is entitled to the deduction for the portion of the rent that they pay.

Wire Transfer Payments

Additional terms and restrictions apply; See Guarantees for complete details. If you’re a Massachusetts resident, you earn a wage in Massachusetts, and your gross income exceeds $8,000, you must generally file a Massachusetts personal income tax return by April 15th following the end of every tax year. Boston Harbor may be the site of the most famous tax protest in history, but today Bay Staters pay taxes on a lot more than tea.

- The two most popular tax software packages are H&R Block At Home, sold by the H&R Block tax preparation company, and TurboTax Federal & State, sold by the Intuit software company.

- The tax is due and payable on the entity’s original return and is due at the same time as the partnership information return or corporate excise return.

- Generally, Massachusetts taxes capital gains as ordinary income.

- Employee’s Federal Insurance Contribution Act rate (e.g., 7.65 percent for social security, 1.45 percent for Medicare-only) to obtain the previous year-to-date FICA contribution.

- H&R Block Free Online is for simple returns only.