Ema-crossover Indicateurs et Signaux TradingView

Contents:

Whenever you go short, and the stock does little to recover and the volatility dries up, you are usually in a good spot. Notice how SGOC continued lower throughout the day; unable to put up a fight. You buy on the original breakout at $144 and sell on the close at $144.60. Remember, if trading were that easy, everyone would be making money hand over fist. Take this chart of AAPL as an example of the chop you might expect. To that point, save yourself the time and headache and use the averages to determine the strength of the move, not proper buy and exits.

I also use dynamic S/R an, a https://traderoom.info/ indicator and the RSI for direccion confirmation, because I am unsure sometimes of what I am seeing. One more thing is that as every rule also the 10EMA has its peculiarities. Most tradable assets usually obey the 10 EMA (month/week/day/hour) however, some of them tend to deviate from it. So to speak, they have their own manner and slightly differ – e.g instead of 10 they obey 12, 15, or something around.

Small Account Option Strategies

Mark the difference between the 5SMA shown above and the 10SMA shown below on the same chart. Trading financial instruments on margin involves a high level of risk which may not be suitable for all investors. Leverage can work against you just as easily as it can work for you. Before deciding to trade you should carefully consider your trading and financial objectives, level of experience, and appetite for risk. The possibility exists that you could sustain a loss of some, or possibly all of your trading capital. Therefore, you should not fund a trading account with money that you cannot afford to lose.

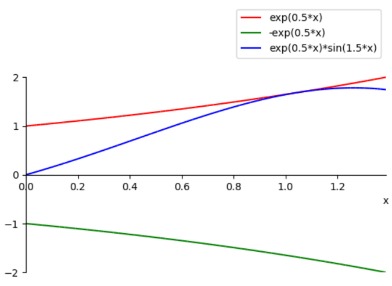

This makes the indicator move much faster, therefore making it better suited for short-term trading. The multiplier is applied for smoothing the indicator and to give more weight to the latest periods. You can see that moving averages are a multi-faceted tool that can be used in a variety of different ways. Go long as the fast moving average crosses to above the middle moving average . The main takeaway of this article is that crossovers, as famous as they are, may be a little late to the party. But with the enormous possibilities and combinations of data, we can never say for sure that the strategy does not work.

Simple Moving Average – When to Sell

In this article, we discuss everything there is to know about moving average crossover, and more. The reason the exponential moving average or EMA is so popular with many traders is because it focusses more on the recent price than the simple moving average does. One of the simplest and easiest to use trading strategies is the 3 moving average crossover strategy. Once we are in a confirmed trend, we can look for the 9 period exponential moving average to cross over the 21 EMA which reverses the short term trend direction. All moving averages are lagging technical indicators however when used correctly, can help frame the market for a trader. You can see how MA’s can give you information about market states by looking at the Alligator trading strategy that I posted a while ago.

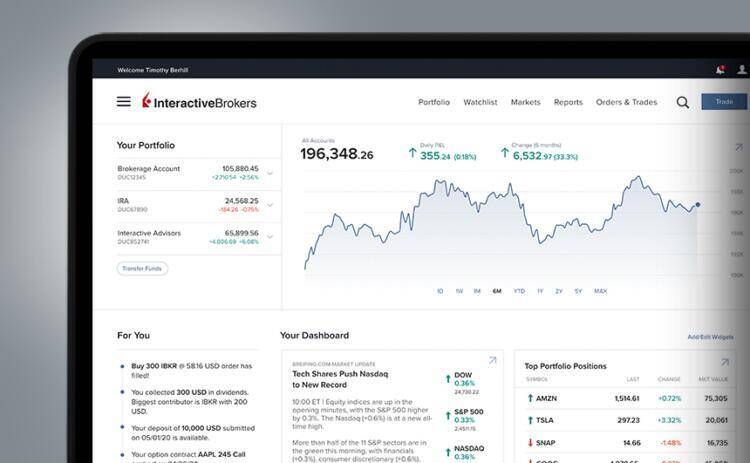

Find out which account type suits your trading style and create account in under 5 minutes. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

What A Market Wizard Taught Me About Moving Averages

Here is an example of how simple moving averages smooth out price movements. The chart below plots three different SMAs on a 1-day BTC/USDT chart. As you can see, the longer the period of the SMA, the more it lags behind the price.

The space between the 20 and 50EMA is to define an area of value, I don’t use it to determine if the trend is coming to an end or not. So you want to be shorting USD/CAD instead of USD/JPY (because it’s a relatively weaker market). This allows you to pick the best market and have a higher probability of the trade working out. And if you want to go short, you’d want to short the weakest market. It has more horsepower, it’s faster, and with a better braking system.

Trend Setters: The Mechanics of Trend-Following Man Institute – man.com

Trend Setters: The Mechanics of Trend-Following Man Institute.

Posted: Sun, 25 Sep 2022 02:10:40 GMT [source]

Basically, the principle of momentum states that a price that is moving up during period t is likely to continue to move up in period t+1 unless evidence exists to the contrary. My working definition for a trend is two retracements then respecting an MA e.g. 9MA or 50MA, they come in all shapes and sizes – and time frames of course. I am constantly watching stock prices movements and I am really surprised about the respect of the EMA’s. I ask this because when the stop loss is away from structure, the risk of the trade would be pretty high compared with the profit target. U are the best teacher ever.ur articles are mind blowing, well simplified, clear and precised.

Moving Average Considerations

In the technical analysis of financial data, moving averages are among the most widely used trend following indicators that demonstrate the direction of the market’s trend. This script gives a buy signal when the 21 EMA crosses above the 55 EMA and a sell signal when the 55 EMA crosses below the 21 EMA. This strategy works well for cryptocurrencies at all time frames. Sometimes, the simple strategies are the best strategies, especially in markets that have not been dominated by… A moving average crossover works best during trending periods, so you trade more markets to capture more trends, which will make you more money.

The BlackBull 3 moving average crossover strategys site is intuitive and easy to use, making it an ideal choice for beginners. Here we’ll examine four different strategies that can be used with a stochastics crossover. In this section we will examine five different strategies based on MA crossovers. So, you may be asking yourself, “Well when will the EMA get me out faster?

Step 1: What is the best moving average? EMA or SMA?

In the example below the 8, 13 and 21 period EMA’s have been added to the chart. When we see the 8 EMA cross above the 13 EMA and then both these EMA’s cross higher above the 21 period EMA we would start looking for long trades. When using the triple EMA crossover strategy you are adding three EMA’s to your chart.

Both the 5-period and 20-period exponential moving averages prices should be above the 50-period exponential moving average prices. Specifically, technical analysis methods include examination of price trends, volume and momentum indicators, moving averages, chart patterns, oscillators, and support/resistance levels. In case of a sideways market, the price of a security trades within a fairly stable range without forming any particular trends for some period of time. In a sideways market, the moving averages may generate false signals because of overlapping of price line. The MACD, short for moving average convergence divergence, is a trend following momentum indicator.

- A short term moving average is faster because it only considers prices over short period of time and is thus more reactive to daily price changes.

- As the name suggests, the simple moving average is the simplest type of moving average.

- Our stop-loss orders will be pips beyond the support/resistance lines, while the take profit order will be at the other side of the channel delimited by them.

- The zero crossover provides confirmation about a change in trend but it is less reliable in triggering signals than the signal crossover.

- Right up to around 11th March, the price moves in a volatile downtrend which forms a descending triangle between 27th January and 8th March.

Whatever you use for your moving average trading approach, ensure you are consistent with each trade you take. You can see the crossover of the averages, the black arrow breaks support level and traders enter short. Using price, market structure, and the EMA’s, you found yourself in two pretty good trades depending on your approach to using the trading signals provided.

By then end, you should be able to identify the system that will work best for your trading style. By adding filters, we are more selective and hence fewer trades. We are buying $500 worth of a Dow Jones stock as one position. Today, we are going to run some backtests to show you some results, determine when it works, when it doesn’t work, and what possible tweaks you can try. Understanding how to read Moving Average signals can lead to incredible results. Create a trade with every order included, a Stop Loss, Take Profit and you can even connect a Trailing Stop order.

slot88

slot88

idn poker

SBOBET

idn poker

slot88

slot88

slot88

slot88

idn poker

slot88

slot gacor maxwin

slot88

idn poker

slot88

slot88

judi bola

slot88

slot88

idn poker

judi bola

slot88

slot88

idn poker

pragmatic play

pokerceme